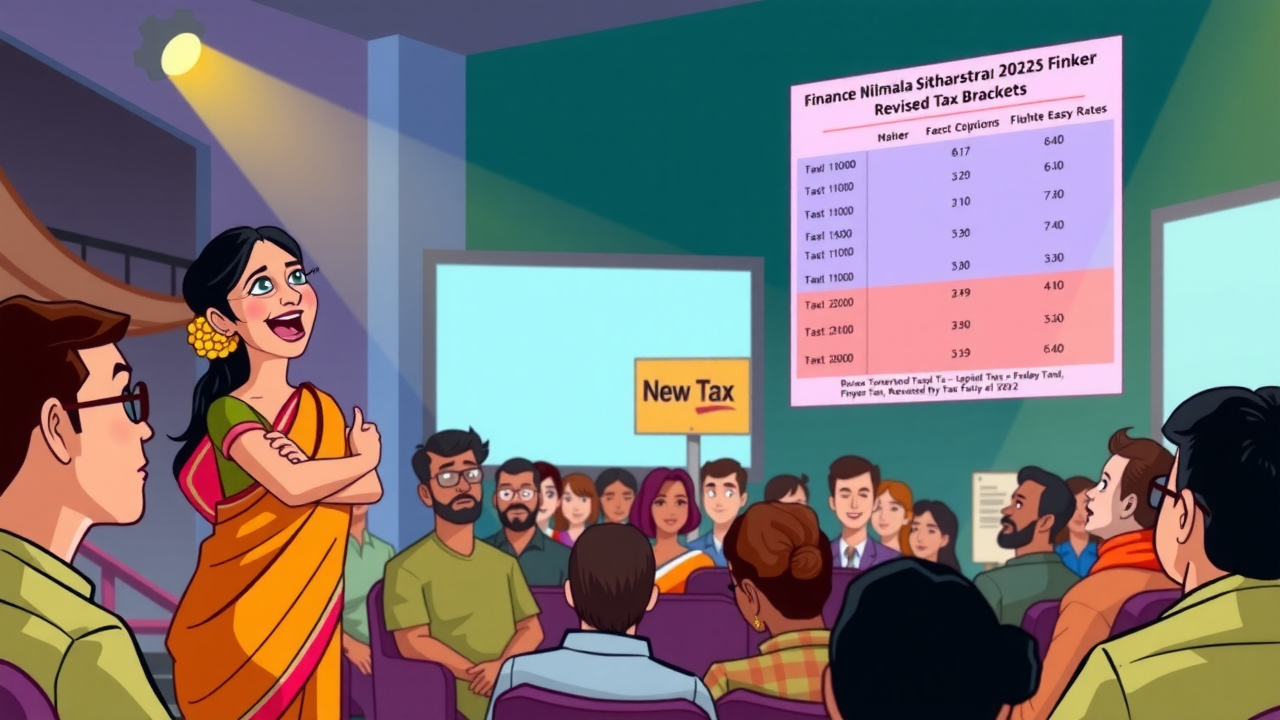

Union Finance Minister Nirmala Sitharaman unveiled revised direct income tax rates under the new regime in the 2024-25 Union Budget, aiming to make the exemption-free system more attractive to salaried taxpayers. The goal is to encourage a shift to the simplified New Tax Regime.

Hallucination-resistant legal AI (context engineered)

Union Finance Minister Nirmala Sitharaman unveiled updated direct income tax rates under the new regime during the presentation of the Union Budget for the fiscal year 2024-25. This marks the seventh time Sitharaman has presented the Budget.

New Tax Regime Rates:

Income up to ₹3 lakh: Nil

Income from ₹3 lakh to ₹7 lakh: 5%

Income from ₹7 lakh to ₹10 lakh: 10%

Income from ₹10 lakh to ₹12 lakh: 15%

Income from ₹12 lakh to ₹15 lakh: 20%

Income above ₹15 lakh: 30%

Previous Tax Regime Rates:

Income up to ₹3 lakh: Nil

Income from ₹3 lakh to ₹6 lakh: 5%

Income from ₹6 lakh to ₹9 lakh: 10%

Income from ₹9 lakh to ₹12 lakh: 15%

Income from ₹12 lakh to ₹15 lakh: 20%

Income above ₹15 lakh: 30%

The New Tax Regime improvements are part of the government’s continuous effort to make this simplified, exemption-free system more appealing to salaried taxpayers. The objective is to motivate more individuals to transition to the NTR, which is presented as a straightforward alternative to the traditional tax structure.