Aug 4, 2020 14:19 UTC

| Updated:

Aug 4, 2020 at 14:19 UTC

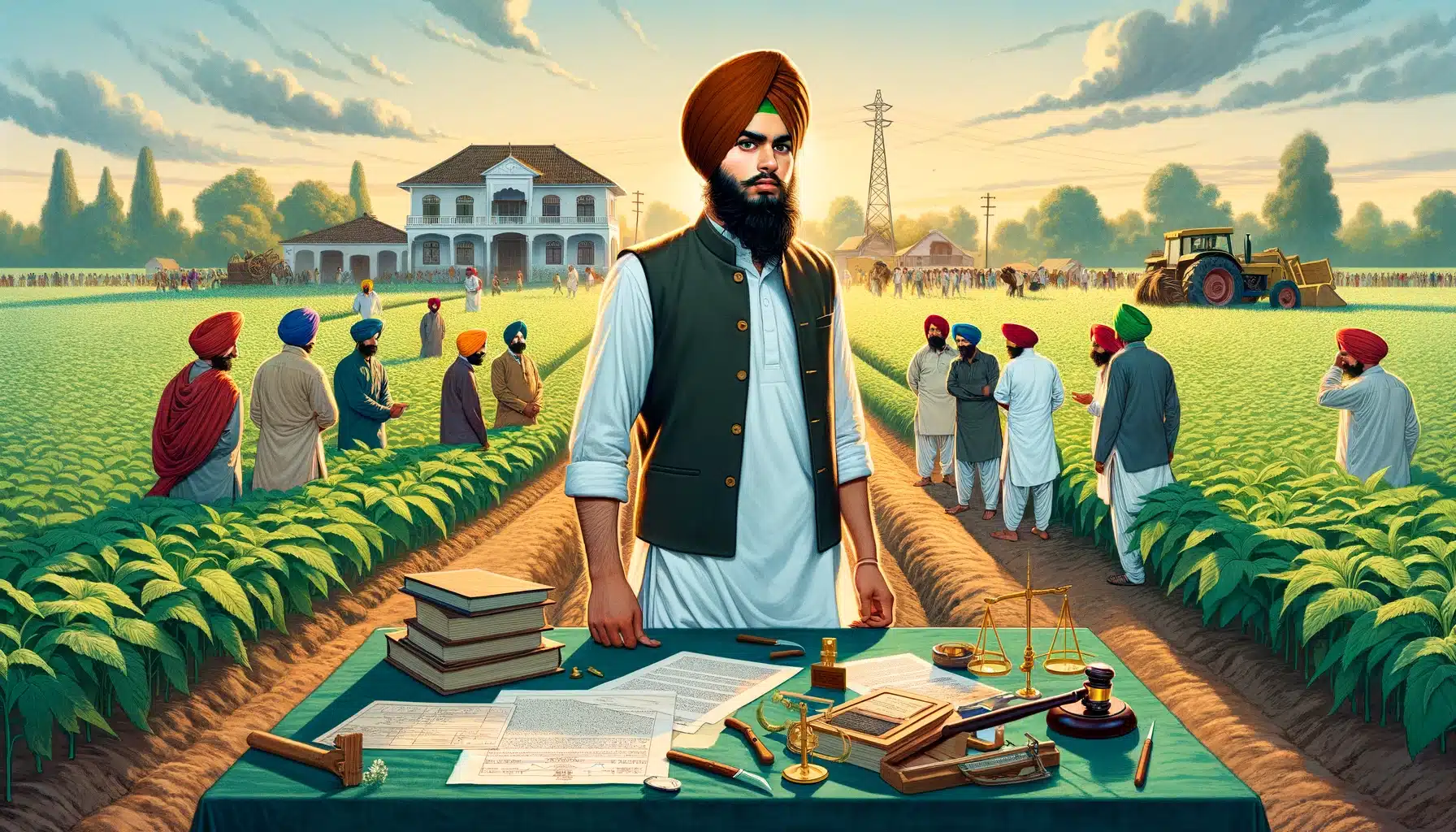

Document required before verification of land

What things are required to be verified before purchasing a land?

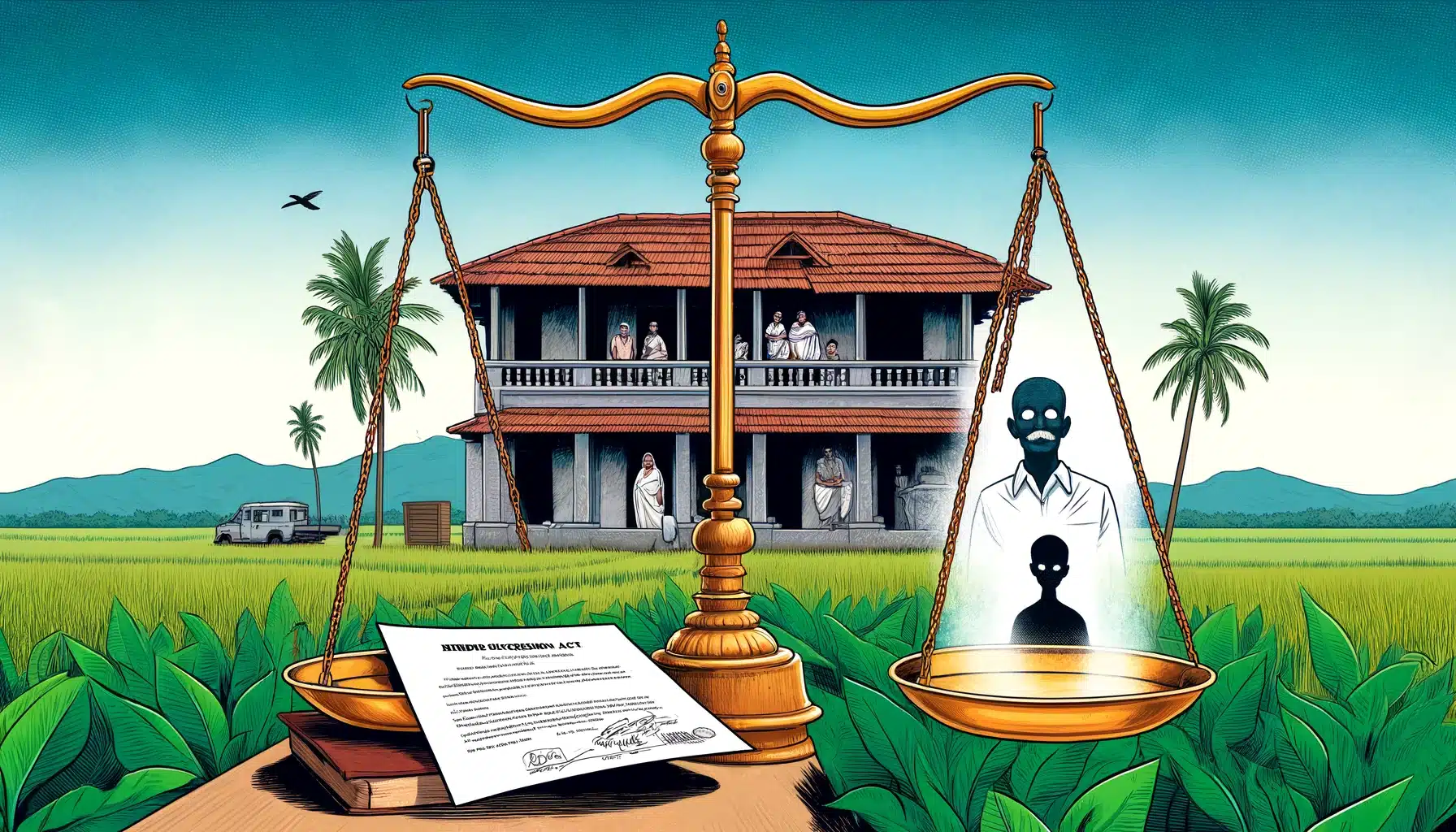

Buying a home is a dream for each person. Every individual strains each nerve from the very childhood by working hard in order to give his best in college to later obtain a high paying job. The motive remains the same, i.e. being independent and owning a private house. While fulfilling this dream one must not act recklessly. There are various compliances and safeguards which must be kept in mind while purchasing a property. The very first involves scrutiny of documents involved. The following documents must be attached and verified while purchasing a property:[1]

Title Deed

It is one of the foremost important things to test for. According to the legal principle, nobody can transfer a better title than he has, the seller cannot transfer his property to a prospective buyer if the title isn’t perfect and free from any encumbrances or defects. The title search of a property can happens at a sub-registrar’s office[2]. The client is entitled to receive all title documents of the property. Check whether the seller has full rights to sell the land and that he is the sole owner of it. You can check these by running a ‘title search’ on the registration website of the state government. You can always consult your lawyer to be sure[3]. This title should be freed from any disputes over the ownership of the property[4]. The title lets the buyers ascertain their ownership rights. Before buying property, one must also ascertain the seller’s ownership over the property. Mere development rights do not amount to ownership.

Tax Receipt and Bills

Before making final payment make sure that the previous owner has cleared all dues like property tax, electricity bills, water bills etc. and there is no outstanding payment. Make enquiry in government and municipal offices for assuring that all the tax receipts and bills are duly paid.[5]

Encumbrance Certificate

It is imperative to understand whether the property is free from any legal dues whatsoever. Similar to the title search, even encumbrances over the property can be looked for at the sub-registrar’s office. This office would supply all the background about the property concerned, on whether there’s any mortgage, or any third party claim, liens, etc. An encumbrance certificate or an EC would have a record of all the transactions done during a stipulated period of time over the property concerned. The sale deed in duplicate must be submitted for obtaining an EC. Further, a form has to be filled for obtaining the Encumbrance Certificate and submitted to the closest Sub-Registrar office.

Master Plan

We often come across sellers or builders of properties who claim certain infrastructural developments. They make big promises of constructing malls, schools, highways and metros. These promises often hold no ground and are merely to entice more and more buyers. Before buying a property, one should closely scrutinize the plan of the property concerned and ascertain for themselves whether these claims would see the sunshine of the day. These master plans can be procured from the local city planning department of your city

House Plan Approval

It is essential for the buyer to simply make sure that the place where the property is found has been approved and also verify whether the building plan has been approved or not. The buyer must also check to determine whether any building bye-laws are violated. The building planning and therefore the layout should be according to the National Building Code of India. The layout also has to be following the norms of GRIHA (Green Rating for Integrated Habitat Assessment)[6].

Agriculture to Non-Agricultural Land Conversion Certificate

It’s very important to make sure that the house one needs to purchase is not classified as agricultural land. Any land which is designated as an agricultural land can’t be used for residential purposes, if it is so done, then it’ll be rendered illegal. Therefore, if you have got reasons to believe that the plot you’re purchasing would fall under agricultural property, make sure that you’re given a conversion certificate issued by the suitable revenue authorities. A conversion certificate is required to alter the purpose of land use from agricultural to non-agricultural. The planning department of the concerned city must issue a No objection Certificate to be used for agricultural land for non-agricultural purposes.

Land Use Certificate

Constructing a property for residential purposes in a commercial zone is prohibited. In order to make sure about the zone your property lies in, one must apply to the development authority of the concerned city to verify about the same.

No Objection Certificate

No objection certificates should be obtained wherever necessary. The seller should provide you with a replica of the urban non-ceiling No-Objection Certificate and NOCs for water, electricity, etc. as well.

Commencement Certificate

This certificate is important for any construction of a property to commence. This is often issued by the urban planning department after scrutinizing the building layout, plan, superstructure, etc.

Property Tax Receipts

Tax receipts should be checked to make sure whether the seller of the property has paid all tax accruing on the property for the past 3 years to the authorities. You must recheck all the previous receipts of land tax if you’re buying a property that’s being resold.

Sale Deed

Before executing a procurement deed, the customer should make sure that the property incorporates a free title. Sale Deed is one of the foremost important legal documents. It indicates that the property has been sold and also the ownership of the property has been transferred from the vendor to the purchaser. Before executing a procurement deed all charges like capital levy, electricity and water charges, maintenance, and housing society charges should be given.

Khata Certificate/ Extract

Khata when translated to English means “account”, it’s essentially the account of a seller or the owner of the property. A Khata extract is important for getting the property. This is often of prime importance for not only transferring property but also for the registration of the new property.

Completion Certificate (for a constructed property):

A Completion Certificate is issued by the municipal authorities denoting that the building is in compliance with their rules in terms of height, distance from the road, and is made as per the approved plans, etc. This document is vital at the time of buying a property and seeking a loan.

Occupancy Certificate (for a constructed property):

When the builder applies for this Certificate, an inspection is meted out by the authorities to make sure that the development meets all the required norms. This certificate is obtained after the completion of the development. It’s important at the time of shopping for a property, seeking a consumer credit, before the builder allows people to require possession of the property and, for the transfer of Khata. It certifies that the project is prepared for occupancy.

Encumbrance Certificate (EC):

Encumbrance means charges within the ownership or liabilities created on a property that’s held against a consumer credit as security. An EC consists of all the registered transactions done on the property during the amount that the EC is sought. Simply put, it’s a certificate explorer for a specific period evideving the property purchase/sale, the presence of any transaction, or mortgage. Encumbrance certificate: Another one to add to your roster, the encumbrance certificate ensures that the plot or the land is not tied down by any legal debt[7]. One should submit a replica of the Sale Deed to get an EC. An individual applying for an EC should fill within the Form 22, affix a non-judicial stamp and submit it to the jurisdictional sub-registrar’s office. Complete residential address, property survey number, property location, the sought period, property description, its measurements, and bounds should be mentioned within the Form. A nominal fee amount is charged yearly. The time taken to get an EC is between 3-7 working days or more.

Betterment charges receipt:

Betterment charges also are referred to as improvement fees/development charges that are to be paid before a Khata are often issued. Currently, the developers are entitled to pay a hard and fast amount as betterment charges to the municipal body. A receipt of the identical should be obtained at the time of purchasing the property.

[1] Source link.

[2] Source link.

[3] Source link.

[4] Source link.

[5] Source link.

[6] Source link.

[7] Source link.