Hindu succession act, 1956 is an amalgamation of various rights of parties who are going to inherit the property through succession.

INTRODUCTION

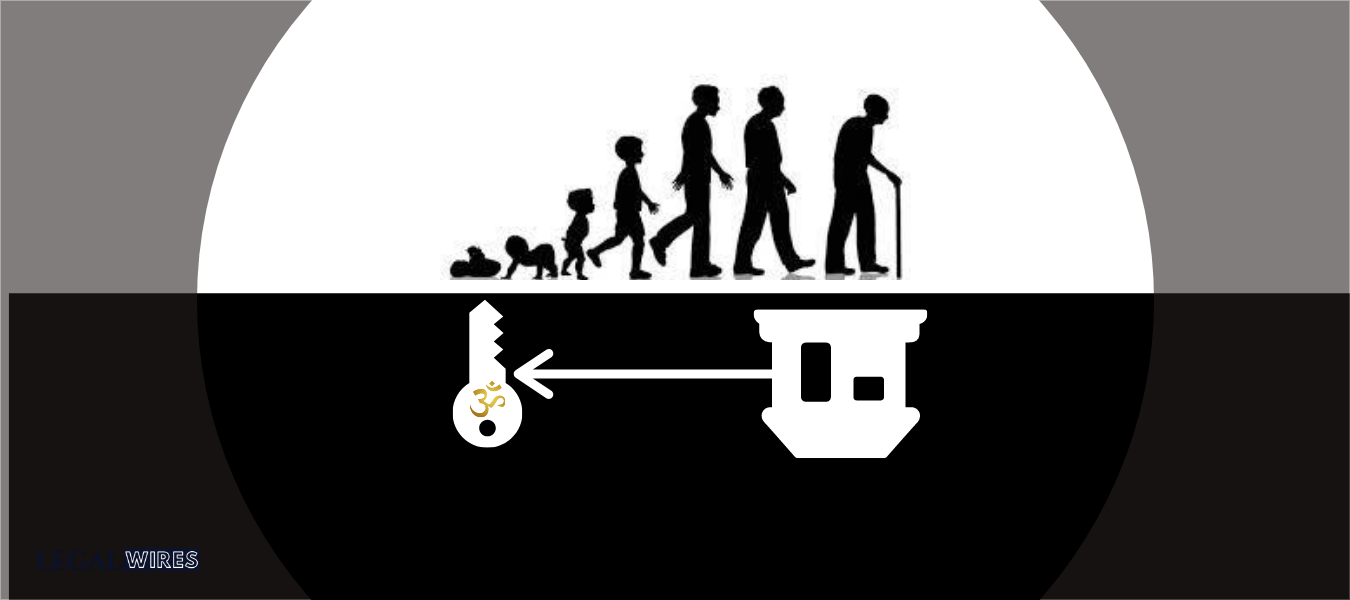

Hindu succession act, 1956 is an amalgamation of various rights of parties who are going to inherit the property through succession. It basically deals with the intestate succession in which a person dying hasn’t made any will or dispose of his/her property by testamentary succession which specifically dealt with the Indian succession Act. In this research paper the author is going to discuss basic provision under the Hindu Succession Act, 1956 which states the normal rule related to the succession of the property and further digging into the concept which relates with the disqualification of a person to inherit the property.

There are specific legal provisions in relation to the succession which are generally referred to as general provision of succession under section 18 to 28 of Hindu Succession Act, 1956. These legal provisions apply to all the situations in which either property belongs to a Hindu male or female dying intestate. These provisions are supplementary to the section 5 to 17 of the act. This research paper tries to de- codify those provisions aiming its main focus on how preferential rights are created towards a person , how pre-emption rights are created and more like these, as given under provisions and how various disqualification works in relation to the division of property through succession.

GENERAL PROVISIONS IN RELATION TO SUCCESSION

There are certain general provisions identifying with the succession, as set down from section 18 to 28 of the Hindu Succession Act, 1956. Section 18 discusses half blood and full blood relations and succession among them, while section 19 manages per stirpes and per capita rules. Section 20 is about succession with respect to a posthumous child. Section 21 manages assumption in instances of simultaneous death and section 22 preferential rights or right of pre-emption individually. Section 23 (special provision respecting dwelling –house) & 24 (Certain widows remarrying may not inherit as a widow ) are repealed by Hindu Succession (amendment) Act of 2005 and moving further section 25, 26 , 27 and 28 speaks about the disqualification to inherit the property which includes murderer & convert descendant disqualified.

DIFFERENT POSITION AS STATED IN THE PROVISIONS

The provision related to this rule into two parts, in first part it is stated about the idea that how rights are created towards a person, second will states that presumption in case of simultaneous death and pre-emption rights

PREFERENCE OF FULL BLOOD OVER THE HALF BLOOD

The bare provision of HSA under Section 18 states that, “Heirs related to an intestate by full- blood shall be preferred to heirs related by half-blood, if the nature of the relationship is same in every other respect.

To understand this, first we have to know the concept of full blood and half blood which has been given in section 3 (e) of the HSA, stating that when two person are said to be related with each other by full blood when they are descended from a common ancestor by a similar wife and on the other hand they are said to be related by half blood when they are descended from common ancestor but different wives.

Section 18 makes it very clear that, this section has general applicability to male and female heirs as it does not refer to the sex of the heir rather speaks of the kinds of relationship that two heirs may have with respect to the intestate, which was also later on confirmed by Hon’ble supreme court in Satya Charan v Urmila , holding that there can be no distinction on the ground of sex of the heir[1] therefore, heirs of full blood brother , would exclude the heirs of a half blood sister, not because of sex of the sister but because of the preference to full blood relationship.

DIVISION OF SHARES WHEN TWO OR MORE INHERITING

Moving further the another issue comes, as who will take how much shares if two or more heirs are succeeding together to the property of the deceased, on this point, author wants to state which is also enshrined in section 19, that the general rule of distribution of property under Hindu law, was the per capita rule. In present it is the general rule, that if two or more heirs succeed together, such as a son, daughter and mother of a male intestate, they will take the property per capita (a share each) and not per stripe, as tenants-in-common and not as joint tenants. Joint tenancy rule was applicable in the case of an undivided interest in a Mitakshara coparcenary only. Further, Tenants-in-common means that two or more heirs together take the property, but they take it individually, in their own right. Their shares are specified and if before the demarcation, one of them dies, his share passes to his own heirs and does not go by survivorship to the co-heir.

For example, two widows succeeding together to their husband’s property will take their husband’s property as tenants-in-common[2] meaning thereby they will take the property together but it will be divided in between two. Similar would be the position of two daughters inheriting the property of their father or a daughter and a widow. Joint tenancy means that where two or more heirs succeed together and hold the property as joint tenants, if one of them dies, the other takes the share of the deceased by survivorship and prevents it from going to his legal heirs.

RIGHTS OF CHILD IN WOMB

Further, one of the important concept has to be drawn here which is provided under Section 20 of the HSA, that a person who was in the womb at the time of the death of an intestate and who is subsequently born alive shall have the equal right to inherit to the intestate as if the child had been born before the death of the intestate and the inheritance shall be deemed to vested in such case with effect from the date of the death of the intestate.

A child in the womb of a mother is presumed to be born before the death of the intestate, although he/she is born subsequently. If the child was conceived, at the time when the death of the intestate happened but was not born alive, no share can be given to him. However, if he was born alive, but died later, the property will be deemed to vest in him from the date of the death of the intestate. This right comes into force at the time of birth of the child but has a retrospective effect viz. from the date of the death of the intestate, it is immaterial whether the other heirs were aware of the fact of the pregnancy or not.[3]

To quote Mulla[4], “It is by fiction or indulgence of the law that the rights of a child born in justo matrimonio are regarded by reference to the moment of conception and not of birth and the unborn child in the womb, if born alive is treated as actually born for the purpose of conferring on him benefits of inheritance.

PRESUMPTION IN CASES OF SIMULTANEOUS DEATH:

Section 21 lays down a presumption in case of simultaneous deaths that the younger person survived the older. This operates only in cases where persons die in circumstances rendering it uncertain as to who died first as for all purposes affecting succession to property, it shall be presumed, until contrary is proved, that the younger survived the earlier.

Where in cases of calamity or accidents or other sudden events like earthquakes, devastating fires, floods, road, train or airplane accidents, etc., two or more relations die together and it is difficult to figure out as to who died first, the presumption that applies is that the older person died first and the younger later.

For example, both the father and the son died in an air crash. It will be presumed that the father died first and the son died a little later. It is only a presumption and can be rebutted by concrete evidence. Where a mother and her daughters are murdered, or they die together in a fire accident, it would be presumed that the mother died first. The presumption is applied in order to avoid the confusion that may arise with respect to the distribution of the property of the deceased among their heirs.

In this section the presumption of survivorship applies, by which the younger is presumed to survive the older. In this section, younger means younger in status not in age and only when the status is the same, younger in age. Thus, if an uncle aged 30 years and a nephew aged 35 years, die in a plane crash, it will be presumed that the nephew died later, even though he is older in terms of actual age. On the other hand, if two brothers die simultaneously in any accident or calamity, the brother younger in age is presumed to have died later. This is a peculiar feature of this Act, as it was altogether not provided for at all in the classical law or the previous legislation regarding Hindu succession.

RIGHT OF PREEMPTION

Section 22 of HSA provides a preferential right to other heirs or heirs to acquire property when one of them desires to transfer his or her interest in the property inherited. The main purpose behind this provision is to ensure that the property remains in the hands of the co-heirs, to prevent the fragmentation of the estate and to avoid the introduction of strangers into the family business.

There is a bit of contradiction in this section as although the opening words here indicate that a male or a female may carry on the business but Pre-emption right is only available when a male intestate dies, it does not apply when the property of female intestate is inherited by her heirs. It is confined only to the class-I heirs of the male intestate, being in personal character, available only to the co –heirs and is neither transferable nor heritable as it would frustrate the main object of this provision under the HSA. Thus, where all the class-I heirs sell their respective shares to one person, except one heir, and such heir dies before a decree is passed in her favour, her legal representatives cannot be substituted in her place, for the continuation of the suit or for the exercise of this right. The suit will abate, and the right of pre-emption would come to an end.

Here are the some basics ingredients for the right of preemption:

a) the property inherited is an interest in an immovable property or in any business;

b) property is inherited by two or more heirs specified in the class-I category;

c) one of such heirs proposes to sell or otherwise transfer it;

d) the consideration is based on mutual agreement and in absence of any agreement, it can be decided by the court.

If the condition above is satisfied, then the other heirs have the preferential right to purchase the interest of the heir who is selling it off. Further, the difference of opinion comes when two or more heirs are keen to purchase the share, in that scenario the one who offers the highest consideration will be preferred. This right of the heirs to acquire the property of a co-heir is called a right of pre-emption. It is not a preferential right to obtain the share of a co-heir, but is a preferential right to purchase the interest of an heir who wants to sell it at a certain price. It implies willingness on both sides and the consideration plays a predominant role, as no person, even for the sake of preventing a fragmentation of estates, can be compelled to sell his property or a share in the property, at below the market price or for free. At the same time, he is not permitted to be unusually greedy or unreasonable. If he demands an unreasonable or an exorbitant sum of money, the court can settle the dispute with respect to consideration.

[1] AIR 1970 SC 1714

[2] Sundarammal v. Sadasiva Reddiar AIR 1959 Mad 349

[3] Pushpatti Nath v Ravi Prakash Gaur, AIR 2003 P&H 372

[4] Mulla’s principles of Hindu law vol I (19ed 2005) 101– 363