In Sampelly Satyanarayana Rao v. Indian Renewable Energy Development Agency Ltd., the Supreme Court ruled that post-dated cheques issued as security can attract liability under Section 138 of the Negotiable Instruments Act if they represent a legally enforceable debt at the time of dishonor. The Cou

“If on the date of the cheque, the liability or debt has become enforceable, dishonour of such cheque would attract penal provisions of Section 138 of the Negotiable Instruments Act.”

Citation: (2016) 10 SCC 458

Date of Judgment: 19th September, 2016

Court: Supreme Court of India

Bench: Hon’ble Dipak Misra (J), Adarsh Kumar Goel (J)

Facts

- The appellant, Sampelly Satyanarayana Rao, was a director of a company engaged in power generation. The respondent, Indian Renewable Energy Development Agency Ltd., is a government enterprise involved in renewable energy development.

- On March 15, 2001, the respondent granted a loan of Rs. 11.50 crores to the appellant’s company for setting up a 4 MW Biomass-based power project in Andhra Pradesh.

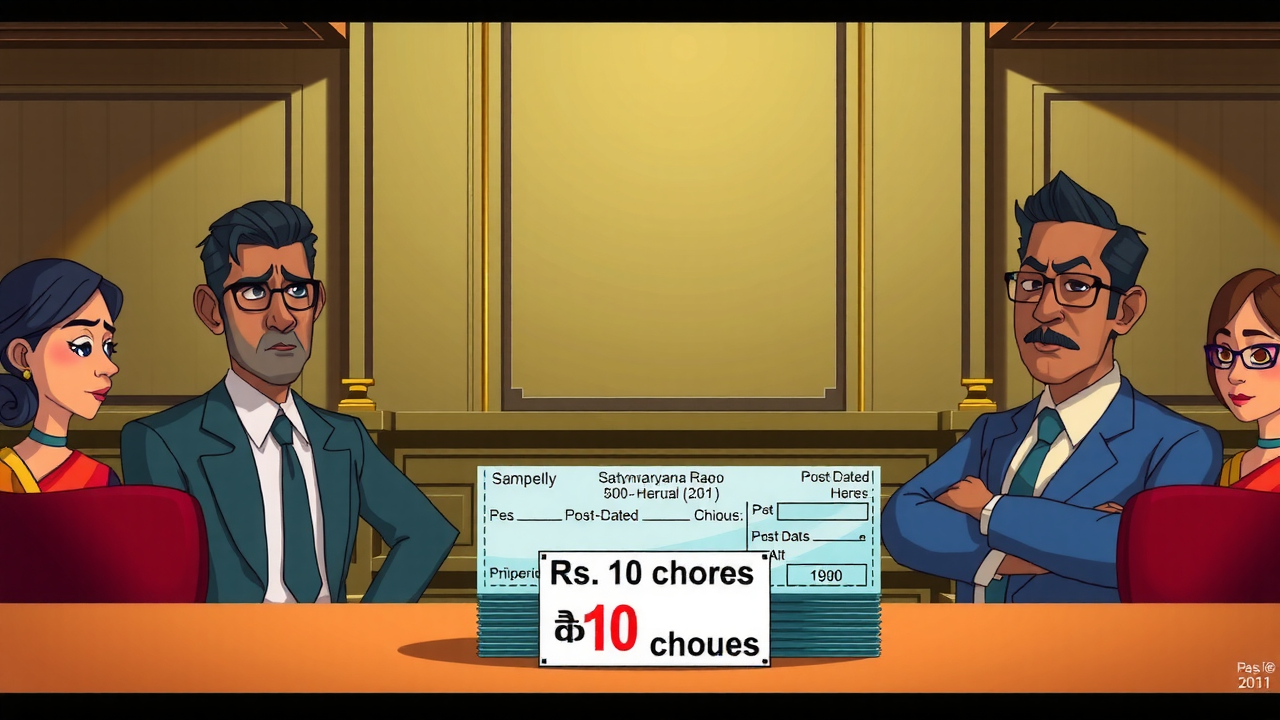

- As per the loan agreement, post-dated cheques were provided by the appellant towards the repayment of loan installments (both principal and interest). The cheques were described as “security” in the agreement.

- The respondent filed complaints under Section 138 of the Negotiable Instruments Act after 18 post-dated cheques issued by the appellant’s company, amounting to approximately Rs. 10.3 crores, were dishonored.

- The appellant sought to quash the complaints, arguing that the cheques were given as “security” and not towards discharge of a debt or liability in praesenti (at present). Thus, dishonor of such cheques should not attract liability under Section 138 of the Negotiable Instruments Act.

Decision of the High Court

The Delhi High Court rejected the appellant’s contention and held that the post-dated cheques represented payment towards a debt that was due and payable in the future, but it was related to an existing liability created by the loan agreement. The court reasoned that once the loan was disbursed and the installments fell due, the cheques, though termed as “security,” were towards the discharge of a liability. The High Court refused to quash the complaints under Section 138, observing that the issue of whether the cheques were indeed security could be decided during the trial.

Decision of the Supreme Court

The Supreme Court of India upheld the decision of the High Court. It ruled that the dishonor of the post-dated cheques issued for repayment of loan installments did indeed attract liability under Section 138 of the Negotiable Instruments Act. The Court distinguished the case from earlier rulings where post-dated cheques were issued as advance payments for a purchase order, finding that in this case, the cheques were issued for repayment of an existing liability.

The Supreme Court concluded that once a loan is disbursed and installments fall due, the post-dated cheques towards those installments are for the discharge of an existing debt, irrespective of being labeled as “security” in the agreement. The appeal was dismissed, and the matter was remanded to the trial court for adjudication on the merits of the case.

Key legal issues discussed

1. Whether post-dated cheques issued as security for a loan, if dishonoured, can attract an offence under Section 138 of the Negotiable Instruments Act, 1881?

Yes

The Court clarified that the nature of the cheque, whether it was issued as security or otherwise is irrelevant to the application of Section 138.

What matters is whether the cheque was issued in discharge of a legally enforceable debt or liability. In this case, although the cheques were initially issued as security, they were presented for payment after the loan had been disbursed and the installments had fallen due. Therefore, by the time the cheques were dishonoured, they represented a legally enforceable debt, attracting the provisions of Section 138.

The Court emphasized that the description of the cheques as “security” does not diminish their enforceability if the debt or liability exists at the time of their presentation for payment. Once the liability has become enforceable, dishonour of such cheques would invoke the penal provisions of Section 138. This interpretation aligns with the purpose of Section 138, which aims to ensure that cheques are honoured and to penalize those who issue cheques that subsequently bounce due to insufficient funds.

The court noted in para number 11, “Once the loan was disbursed and installments have fallen due on the date of the cheque as per the agreement, dishonour of such cheques would fall under Section 138 of the Act. The cheques undoubtedly represent the outstanding liability.“

However, the Court distinguished the present case from other cases where by noting that in Sampelly’s case, the loan had already been disbursed, and the installments had fallen due. Therefore, the post-dated cheques were presented against a matured and enforceable debt, unlike the situations where the installments are not yet due or, where the purchase order had been cancelled, and no liability existed at the time of cheque presentation.

The court referred to Indus Airways Private Limited v. Magnum Aviation Private Limited[1] to discuss whether post-dated cheques issued as advance payment for a purchase order could be considered for discharge of legally enforceable debt. The Court held that cheques issued for advance payment that were later dishonoured do not attract liability under Section 138 because they were not issued to discharge a debt or liability in praesenti.

2. Whether the presumption of legally enforceable debt under Section 139 can be rebutted based on the accused’s own statement?

No

The Court discussed that once the issuance of a cheque and the signature on it are admitted, there arises a presumption under Section 139 of the Negotiable Instruments Act that the cheque was drawn for the discharge of a legally enforceable debt. It is the responsibility of the accused to rebut this presumption. However, a mere statement by the accused is not sufficient to rebut the presumption. The accused must provide evidence or rely on the material submitted by the complainant to substantiate their defense. The Court emphasized that “mere statement of the accused may not be sufficient to rebut the said presumption.”

The court held in para 18 of the judgment “In Rangappa v. Sri Mohan[2], this Court held that once issuance of a cheque and signature thereon are admitted, presumption of a legally enforceable debt in favour of the holder of the cheque arises. It is for the accused to rebut the said presumption, though the accused need not adduce his own evidence and can rely upon the material submitted by the complainant. However, mere statements of the accused may not be sufficient to rebut the said presumption.“

The court referred to Rangappa v. Sri Mohan wherein the Supreme Court held that once the issuance of a cheque and the signature thereon are admitted, a presumption of a legally enforceable debt arises in favor of the holder of the cheque. The accused has the burden to rebut this presumption, and mere statements by the accused are insufficient; they must provide substantial evidence to rebut the presumption.

3. Whether the appellant’s defense of issuing cheques as security absolves him from liability under Section 138?

No

The appellant’s argument that the cheques were issued only as security and therefore did not represent an enforceable debt was rejected by the Court. The Court noted that the critical factor in determining liability under Section 138 is whether a debt or liability existed at the time of dishonour. In this case, the debt had matured, and the cheques were issued to cover the repayment of that debt. As a result, the dishonour of the cheques attracted liability under Section 138, even though they were initially issued as security.

The court held in para number 10,”We are of the view that the question whether a post-dated cheque is for ‘discharge of debt or liability’ depends on the nature of the transaction. If on the date of the cheque liability or debt exists or the amount has become legally recoverable, the Section is attracted and not otherwise.“

The court referred to Rallis India Ltd. v. Poduru Vidya Bhushan[3] wherein it was highlighted that the High Court should not interfere at the threshold with the cognizance taken by the trial court. The determination of whether a cheque represents a legally enforceable debt or was issued as security should be left to the trial court to decide based on evidence.

[1] (2014) 12 SCC 539.

[2] 2010) 11 SCC 441.

[3] (2011) 13 SCC 88.