Hindenburg Research has made serious allegations against SEBI Chairperson Madhabi Buch and her husband, accusing them of holding stakes in offshore funds tied to the Adani Group’s alleged money siphoning scandal. The whistleblower documents reveal potential conflicts of interest, including Buch’s un

In a significant development, Hindenburg Research, the U.S.-based short seller known for its controversial reports, has leveled serious allegations against Madhabi Buch, the Chairperson of the Securities and Exchange Board of India (SEBI), and her husband Dhaval Buch. These allegations stem from the couple’s alleged involvement in offshore funds that were reportedly used in a money siphoning scandal linked to the Adani Group. Hindenburg’s latest report, citing “whistleblower documents,” accuses Buch and her husband of holding stakes in obscure offshore funds implicated in the Adani scandal, potentially leading to a conflict of interest given her role as India’s stock market regulator.

Allegations Against Madhabi Buch and Dhaval Buch:

- Hindenburg Research has accused Madhabi Buch and her husband of having stakes in offshore funds connected to the Adani Group’s alleged money siphoning activities.

- The short seller claims that despite India having “thousands of mainstream, reputable onshore mutual fund products,” the Buchs “had stakes in a multi-layered offshore fund structure with minuscule assets, traversing known high-risk jurisdictions.”

- The offshore funds in question were allegedly overseen by a company linked to the Wirecard scandal and operated by an Adani director. These funds were also reportedly used by Vinod Adani in the alleged money siphoning scheme.

Involvement in Offshore Funds:

- According to the documents cited by Hindenburg, Madhabi Buch and her husband first opened their account with IPE Plus Fund 1 on June 5, 2015, in Singapore.

- These offshore funds, based in Bermuda and Mauritius, were allegedly found within the same complex nested structure used by Vinod Adani.

- Two weeks before her appointment as SEBI chief, Dhaval Buch allegedly communicated with Trident Trust, the Mauritius fund administrator, regarding his and his wife’s investment in the Global Dynamic Opportunities Fund (GDOF). In this communication, Dhaval Buch requested to “be the sole person authorized to operate the Accounts.”

SEBI’s Inaction and Potential Conflict of Interest:

- Hindenburg highlighted that the Supreme Court Expert Committee Report from May 6, 2023, indicated that SEBI had “drawn a blank” in its investigations into the funding of Adani’s offshore shareholders. Hindenburg remarked that it finds it “unsurprising that SEBI was reluctant to follow a trail that may have led to its own chairperson.”

- Hindenburg also alleges that from April 2017 to March 2022, while Madhabi Buch was a whole-time member and chairperson at SEBI, she had a 100% interest in a Singaporean consulting firm, Agora Partners. On March 16, 2022, two weeks after her appointment as SEBI chairperson, she allegedly transferred the shares to her husband.

- Currently, Madhabi Buch is said to have a 99% stake in an Indian consulting business called Agora Advisory, where her husband is a director. In 2022, this company reported consulting revenue amounting to $261,000, which Hindenburg claims is “4.4 times her disclosed salary at SEBI.”

Blackstone Connection and REITs Approval:

- Hindenburg further questioned the role of Dhaval Buch during Madhabi Buch’s tenure as a whole-time member at SEBI. He was appointed as an Advisor to Blackstone, a major player in the REIT (Real Estate Investment Trust) market.

- The short seller alleges that Madhabi Buch publicly supported REITs, calling them a “nascent asset class,“ which led to significant benefits for Blackstone. Blackstone sponsored Mindspace and Nexus Select Trust, India’s second and fourth REITs, respectively, to receive SEBI approval for initial public offerings (IPOs).

- Hindenburg stated, “Either way, we do not think SEBI can be trusted as an objective arbiter in the Adani matter. We think our findings raise questions that merit further investigation. We welcome additional transparency.”

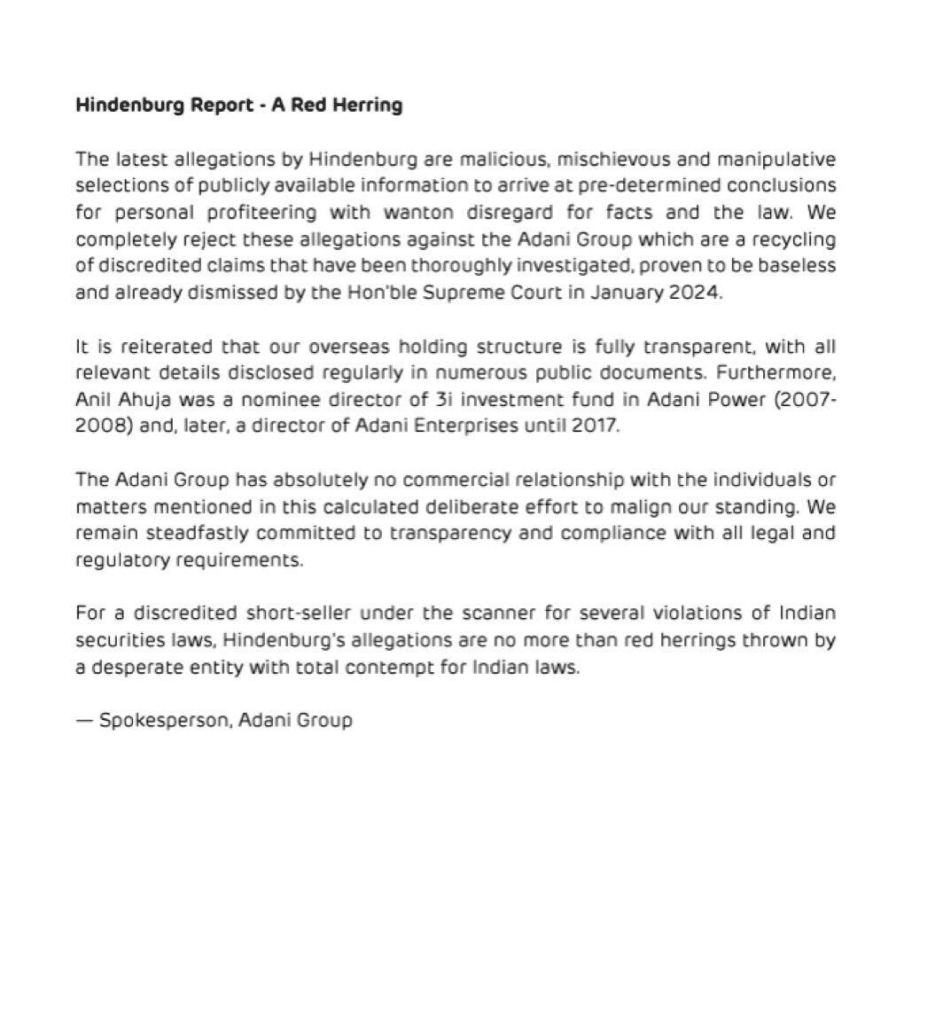

Response from the Adani Group:

- The Adani Group has “completely rejected” these allegations, labeling them “baseless.” A spokesperson for the group said, “It is reiterated that our overseas holding structure is fully transparent, with all relevant details disclosed regularly in numerous public documents.”

- The spokesperson further clarified that Anil Ahuja was a nominee director of 3i Investment Fund in Adani Power (2007-2008) and later served as a director of Adani Enterprises until 2017.

- The spokesperson concluded, “The Adani Group has absolutely no commercial relationship with the individuals or matters mentioned in this calculated deliberate effort to malign our standing. We remain steadfastly committed to transparency and compliance with all legal and regulatory requirements.”

Here’s the full statement: